An emergency fund is often pitched as a financial safety net for unexpected crises like medical bills, car repairs, or job loss. While this is its core purpose, limiting its role to only emergencies overlooks its broader potential. In 2025, with economic uncertainties like inflation and job market shifts, an emergency fund can serve as a versatile tool for financial resilience and opportunity. This guide explores why your emergency fund is more than just a crisis buffer, backed by insights and real-world examples.

The Traditional Role of an Emergency Fund

An emergency fund is money set aside for unforeseen expenses, typically 3-6 months of living expenses ($10,000-$30,000 for most households). It’s stored in a liquid, high-yield savings account (e.g., 4-5% APY with banks like Ally or Marcus) to ensure quick access without penalty. According to a 2023 Bankrate survey, 57% of Americans couldn’t cover a $1,000 emergency without borrowing, highlighting its necessity.

Core Uses:

- Medical emergencies (e.g., $5,000 hospital bill)

- Urgent repairs (e.g., $2,000 for a broken furnace)

- Income loss (e.g., covering rent during unemployment)

But viewing it solely as a crisis fund misses its strategic value. Here’s why it’s more versatile.

1. A Buffer for Financial Flexibility

An emergency fund provides breathing room to navigate life’s uncertainties beyond traditional emergencies. It can act as a bridge during planned transitions or unexpected shifts, reducing stress and enabling smarter decisions.

- Career Transitions: If you’re contemplating a job change or starting a side hustle, your fund can cover expenses while you pivot. For example, a Reddit user on r/financialindependence used their $15,000 emergency fund to cover 3 months of living costs while transitioning to freelancing, avoiding debt during a low-income period.

- Market Downturns: In 2025, with potential economic volatility, an emergency fund can help you avoid selling investments at a loss during a market dip. Instead of liquidating a $10,000 stock portfolio at a 20% loss, your fund covers expenses, preserving long-term wealth.

Real-World Example: A tech worker shared on X how their $20,000 emergency fund allowed them to negotiate a better salary by declining a lowball offer, knowing they had a financial cushion.

2. Seizing Unexpected Opportunities

Your emergency fund can double as an opportunity fund, letting you capitalize on time-sensitive possibilities without derailing your finances.

- Education or Certifications: A $3,000 coding bootcamp or professional certification could boost your income by 20-30%. Your emergency fund can cover this upfront, with the understanding you’ll replenish it later.

- Discounted Investments: If a rare opportunity arises—like buying a rental property at a discount—your fund can provide quick capital, especially if financing isn’t immediately available.

- Travel or Relocation: A last-minute move for a dream job or a discounted travel deal can be funded without dipping into long-term savings.

Success Story: A small business owner used $5,000 from their emergency fund to buy discounted inventory during a supplier’s clearance sale, reselling it for a $12,000 profit. They rebuilt the fund within months, proving its dual role.

3. Preventing Debt in Non-Emergency Situations

Even non-urgent situations can strain finances if unprepared. An emergency fund prevents reliance on high-interest credit cards (average 20% APR in 2025) for expenses that aren’t strictly emergencies but require immediate action.

- Planned Expenses Gone Awry: A wedding or home renovation often exceeds budgets. An emergency fund can cover overruns, like an extra $2,000 for catering, without maxing out credit.

- Temporary Cash Flow Gaps: Freelancers or gig workers may face delayed client payments. A $10,000 fund can bridge a 2-month gap, ensuring bills are paid on time.

Pro Tip: Replenish the fund after non-emergency use to maintain its primary role. Automate monthly transfers (e.g., $200) to rebuild quickly.

4. Psychological and Emotional Benefits

Financial security reduces stress, and an emergency fund’s versatility amplifies this. A 2024 American Psychological Association study found 65% of adults cite money as a top stressor. Knowing your fund can handle both crises and opportunities boosts confidence.

- Avoiding Panic Decisions: With a $15,000 fund, you’re less likely to take a bad job out of desperation or sell assets at a loss.

- Empowering Risk-Taking: Entrepreneurs often use their fund as a safety net when launching ventures. A Side Hustle School podcast featured a teacher who used her $8,000 fund to start an Etsy shop, knowing she could cover expenses if it flopped initially.

How to Optimize Your Emergency Fund for Multiple Roles

To make your emergency fund a multi-purpose tool, follow these steps:

- Size It Right: Aim for 3-6 months of expenses ($10,000-$30,000 for most). If you plan to use it for opportunities, consider 6-12 months for added flexibility, especially for irregular incomes.

- Choose the Right Account: Use a high-yield savings account (4-5% APY) for liquidity and growth. Keep it separate from checking to avoid accidental spending.

- Set Clear Rules: Define what qualifies as an “emergency” or “opportunity.” For example, only use it for opportunities with a clear ROI, like education or business investments.

- Replenish Strategically: After any use, prioritize rebuilding with automated savings or windfalls (e.g., tax refunds). If used for an opportunity, set a timeline to repay (e.g., 6 months).

- Diversify for Goals: Maintain a separate savings account for planned goals (e.g., vacations, home down payments) to complement your emergency fund, ensuring you don’t over-rely on it.

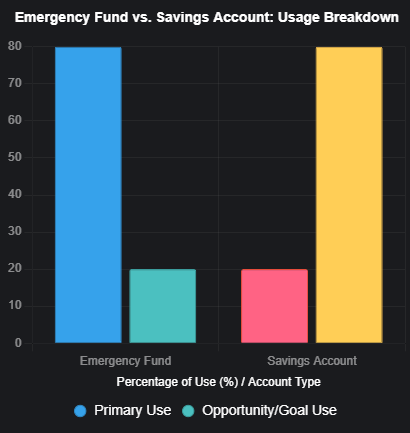

Chart: Emergency Fund vs. Savings Account Usage

Grok can make mistakes. Always check original sources.

This chart illustrates that emergency funds are primarily for crises (80%) but can support opportunities (20%), while savings accounts focus on goals (80%) with minimal emergency use (20%).

Common Mistakes to Avoid

- Overusing for Opportunities: Tapping your fund for non-essential purchases (e.g., luxury items) weakens its emergency role. Set strict criteria for opportunity use.

- Underfunding: A $1,000 fund may not cover major crises or opportunities. Aim for at least 3 months’ expenses.

- Mixing Accounts: Combining emergency and savings funds leads to confusion. Use separate accounts for clarity.

- Ignoring Inflation: Low-yield accounts (0.01% APY) lose value over time. Choose high-yield options to combat 3-4% inflation in 2025.

Real-World Success Story

A freelancer shared on LinkedIn how their $25,000 emergency fund covered 6 months of expenses during a slow client period and later funded a $4,000 marketing course. The course led to a 40% income increase, and they rebuilt the fund within a year, showcasing its dual power.

Conclusion

Your emergency fund is more than a crisis shield—it’s a financial Swiss Army knife. Beyond emergencies, it supports career pivots, seizes opportunities, prevents debt, and reduces stress. By sizing it appropriately (3-6 months), choosing a high-yield account, and setting clear usage rules, you unlock its full potential. Pair it with a dedicated savings account for planned goals to create a robust financial strategy. Start building or optimizing your fund today—your future self will thank you for the security and freedom it provides. For more tips, explore financial communities on X or r/personalfinance.